原色牧野植物大図鑑・2冊/牧野新日本植物図鑑/牧野富太郎/日本の植物の原色図と解説を同じページで対比し全2巻に収録の図鑑は類例を見ない

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :18593525 | 発売日 | 2024/05/24 | 定価 | 15,000円 | 型番 | 18593525 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

原色牧野植物大図鑑・2冊/牧野新日本植物図鑑/牧野富太郎/日本の植物の原色図と解説を同じページで対比し全2巻に収録の図鑑は類例を見ない

原色牧野植物大図鑑・2冊/牧野新日本植物図鑑/牧野富太郎/日本の植物の原色図と解説を同じページで対比し全2巻に収録の図鑑は類例を見ない

商品説明

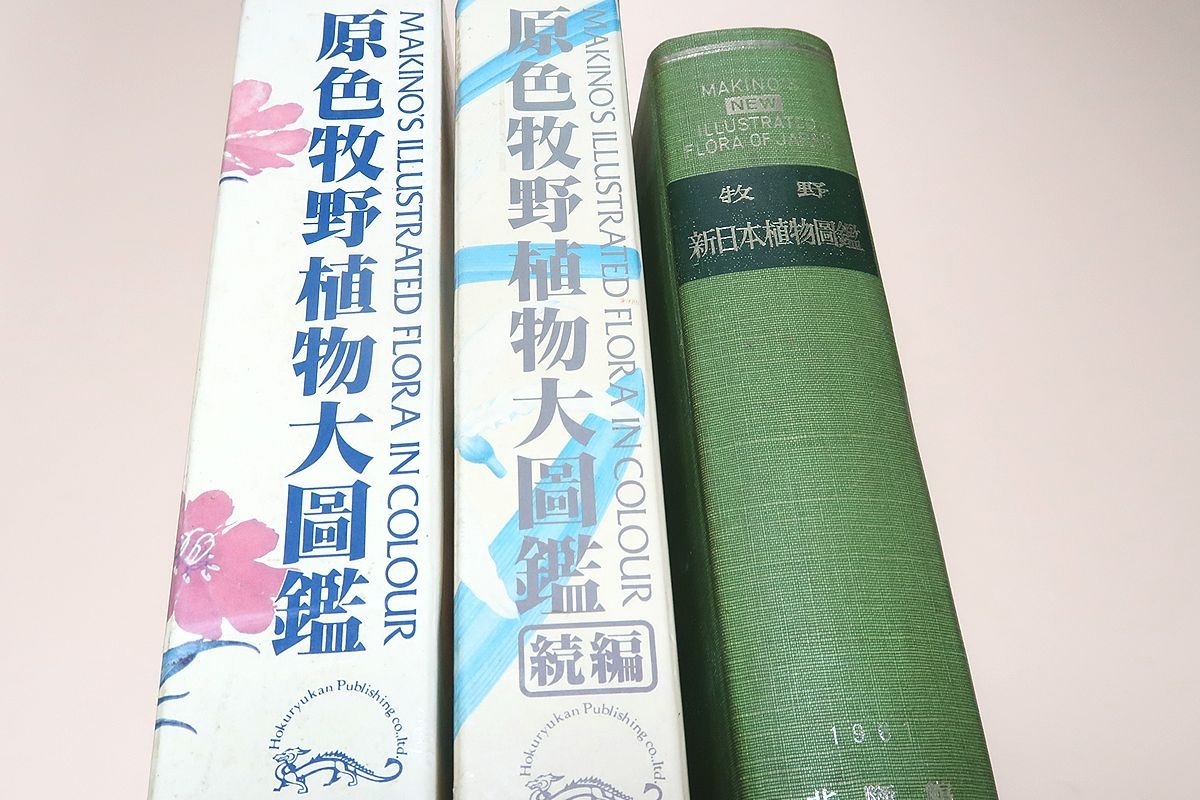

原色牧野植物大図鑑・正続2冊と牧野新日本植物図鑑/牧野富太郎/定価65000円/日本の植物の原色図と解説を同じページで対比され全2巻に収録の図鑑は類例を見ない

牧野氏の植物図鑑3冊でまとめてみました。

牧野新日本植物図鑑:昭和36年

原色牧野植物大図鑑・2冊:昭和57年 906ページ と昭和58年 538ページ カラー図版 重さ約5.85kg 定価合計65000円 いわゆる豪華本ですね。資料用にもいかがでしょうか。

正巻序文より

幸い今回は、関係者の多大な御協力により、この困難な仕事を短期間に実現することができた。2556種に及ぶ日本の植物の原色図とその解説が同じページで対比され、しかも全1巻に収録されている植物図鑑はおそらく他に類例をみないと自負している。更に、弊社としては、この図鑑の完成により、動物昆虫植物の三大原色大図鑑が出そろい、その点からも念願が達成されたことになり、その意義は大きい。

今回はその中から最も一般的と思われる野生種、栽培種、帰化種を2556種選び、それらを親版の原図原型として拡大彩色し、その解説は必要最小限にとどめた。図版が大きいことはこの図鑑の最大の特色で、読者は居ながらにしてバラエティーに富む植物種の実形を鑑賞したり調べることができる。いわば大人のための植物上本ともいえる。また、初心者のために彩色部分図に一々説明をつけたことも始めての試みで、第2の特徴である。

牧野富太郎博士の不朽の名著である戦前版の「牧野日本植物に」と 版の「牧野新日本植物圖鑑」の2著は、発行以来半世紀にわたって多数の 愛好者や研究者をはぐくんできた。この名著を原色化することは、博士? 中からのご希望であったし、出版元である弊社の宿願でもあった。それがあ くも創立90周年記念出版としてここに完成を見たことは何にもましてようろこびにたえない。

採色図による植物図鑑の作成は、カラー写真を用いる場合と異なり171 を精密に彩色し、さらに製版・印刷の段階で入念な色調整が必要となり、時間 ・費用の点で多くの困難を伴うものである。幸い今回は、関係者の多大のね 力により、この困難な仕事を短期間に実現することができた。2,556種において 日本の植物の原色図とその解説が同じ頁で対比され、しかも全1巻に収録され ている植物図鑑は恐らく他に類例を見ないと自負している。さらに弊社といっ は、この図鑑の完成により、動物・昆虫・植物の三大原色大図鑑が出揃い、の点からも念願が達成されたことになりその意義は大きい。

理想的には、親版に収録されている3,900種を原色化することが望ましいか、 知れないが、余りにもぼう大、高価になるので、今回はその中からもっとも、 般的と思われる野生種、栽培種、帰化種を2,556種選び、それらを親版の原因を 原型として拡大彩色し、その解説は必要最小限に止めた。図版が大きいことは この図鑑の最大の特色で、読者は居ながらにしてバラエティに富む植物種の実 形を観賞したり調べることができる。いわば大人のための植物絵本とも言える。 また初心者のために彩色部分図に一々説明を付けたことも初めての試みで第2の特長である。

終わりに、この図鑑の刊行に当たり、ご高齢にもかかわらず編修を承諾され た本田正次先生、図版・解説文の作成を監督指導された諸先生方はじめ製版・ 印刷・製本に献身的協力を惜しまなかった凸版印刷株式会社ならびに担当の方に深甚の謝意を表したい。

お探しの方、お好きな 方いかがでしょうか。ゆうぱっくでの発送になります。

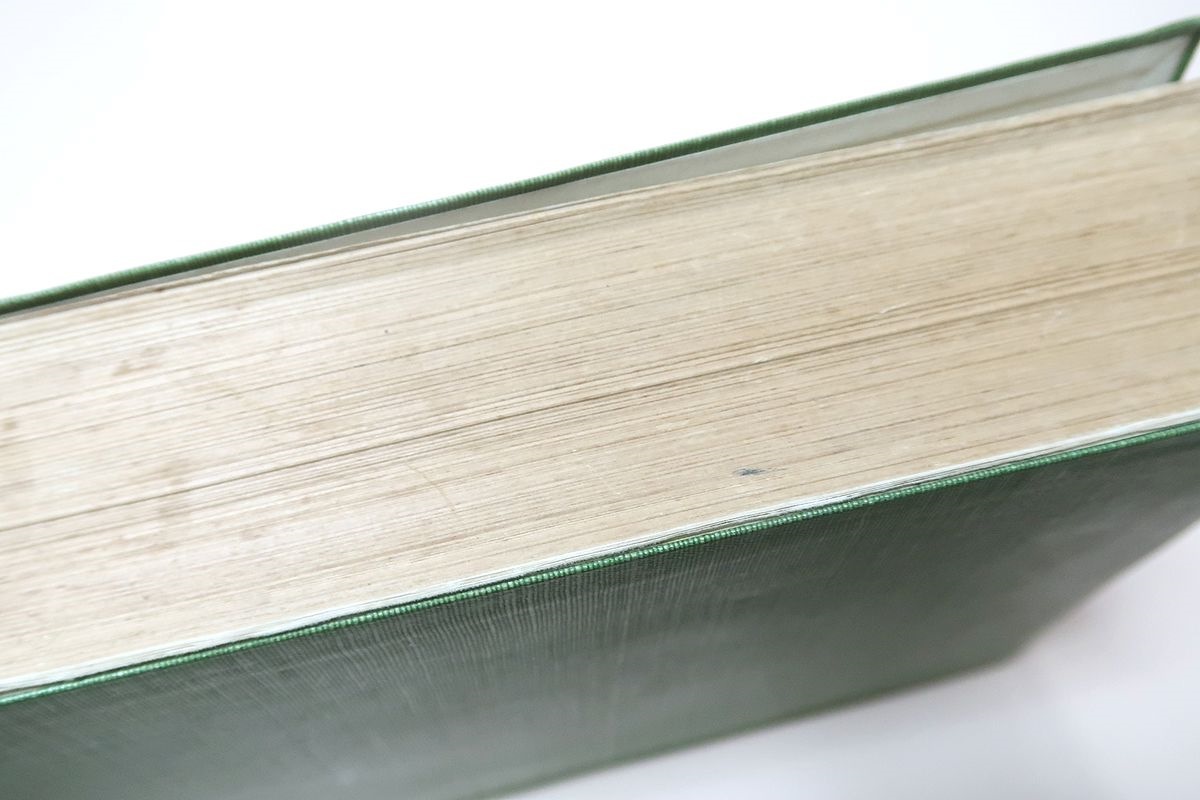

品ですので傷・黄ばみ・破れ・折れ等経年の汚れはあります。原色牧野植物大図鑑・2冊:外箱小傷、小汚れ、やや変色、本体は経年並み。牧野新日本植物図鑑は昭和36年ですので小口やけ、ページ黄ばみ、軽度の割れなど全体的に経年感はあります。ご理解の上、ご入札ください。もちろん読む分には問題ありません。16971

注意事項

できる限りスムーズな取引を心がけておりますので、落札後2日以内にご連絡頂きますようお願い致します。

評価が悪い方からの入札は固くお断りします。評価の悪い方が入札された場合には予告なく削除する場合があります。

細部に至るまではチェックしておりませんので、書き込みや蔵書印等ある場合があります。ご理解の上、ご入札ください。

かんたん決済でおこちらの商品案内は 「■@即売くん5.30■」 で作成されました。

この他にも出品しておりますので宜しければご覧ください。