新入荷再入荷

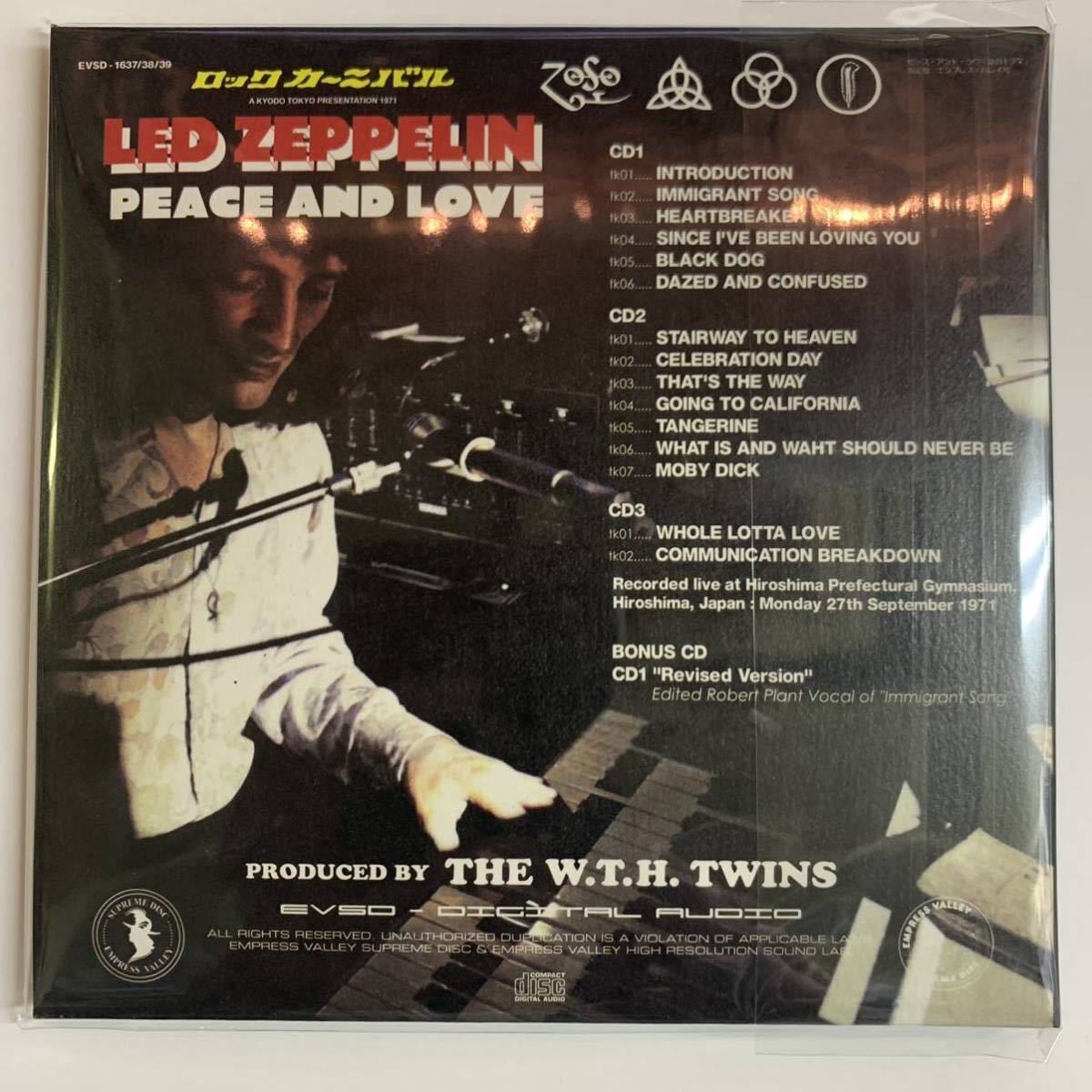

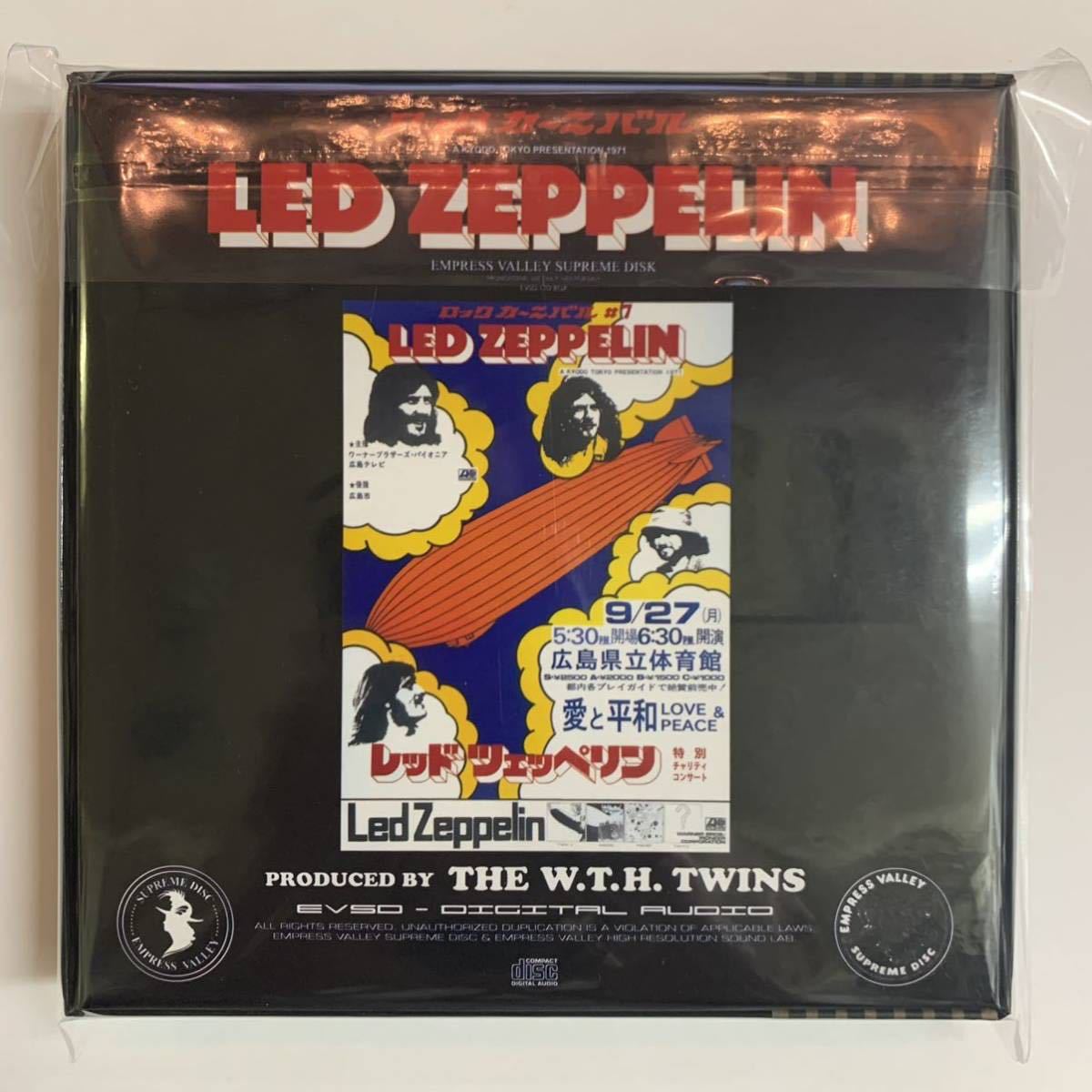

LED ZEPPELIN : LOVE & PEACE「ロックカーニバル広島」6CD+DVD BOX 1971 広島公演 Empress Valley Supreme Disk バージョン2の発売!

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 | 新品 :13967829 | 発売日 | 2023/12/17 | 定価 | 19,800円 | 型番 | 13967829 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

![【フランス語】15冊セット★クレヨンしんちゃん 1~15巻★臼井儀人★Shinchan★Manga 漫画 洋書[28]](https://auctions.c.yimg.jp/images.auctions.yahoo.co.jp/image/dr000/auc0201/users/122f9a8bd1048f83e13276a211a2c2cb1332d341/i-img795x1200-1610499960olqe1u1936.jpg)